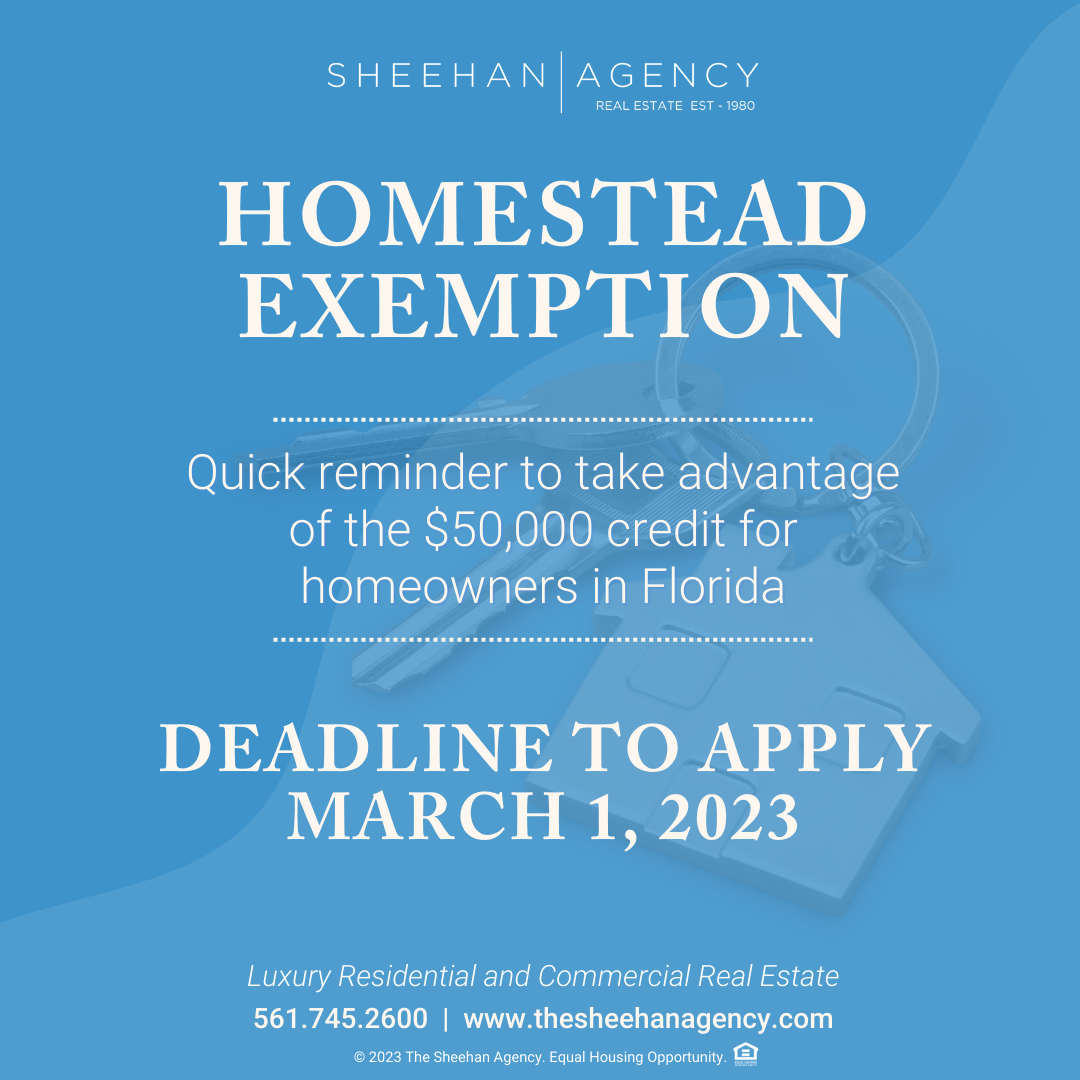

In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property’s assessed value if your property is your permanent residence and you owned the property on January 1 of the tax year. This exemption applies to all taxes, including school district taxes. An additional exemption of up to $25,000 will be applied if your property’s assessed value is between at least $50,000 and $75,000. This exemption is not applied to school district taxes.

When qualifying for the Homestead Exemption, you will need the following documents for all property owners applying:

Florida Driver’s License or Florida ID if you do not drive

Florida car registration

Florida Voter’s ID (if you vote)

Immigration documents if not a U.S. citizen.

Documents should reflect the address of your homesteaded property. Homestead Exemption also qualifies you for the 3% Cap Save our Homes (SOH)

How do I apply?

You have three options to submit your application:

E-File

Complete the application online. Print it out and mail to the Palm Beach County Property Appraiser’s Office, Exemption Services, 1st Floor, 301 N. Olive Ave., West Palm Beach, FL 33401

All homestead exemption applications must be submitted by March 1.

SOURCE:

https://www.pbcgov.org/papa/homestead-exemption.htm